lhdn personal tax relief

There is also a whole other list of personal tax reliefs you can claim the most of your deductions from your chargeable income which is covered in the next. Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5 RM8550.

Updated Guide On Donations And Gifts Tax Deductions

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually.

. Only tax resident individual entitles for progressive tax rates personal reliefdeductions and rebates. Extension of tax relief for deferred annuity premium payments up to RM3000. Your filings for tax relief from life insurance premiums will be subject to approval from the Inland Revenue Board of Malaysia LHDN so remember to keep the receipts of all your premium payments.

Tax relief For individuals in the tax bracket you can claim tax relief of up to RM6000 from life insurance premiums. Youll pay the RPTG over the net chargeable gain. Special Lifestyle Tax Relief Is Stackable For Smartphone Personal Computer Tablet Purchases.

Malaysia Personal Income Tax Guide 2021 YA 2020 Jacie Tan - 25th March 2021. Special Income Remittance Program PKPP For Malaysian Tax Resident With Foreign Sourced Income. Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under.

Under the PENJANA recovery plan there is an increase in income tax relief for parents on childcare services expenses from RM2000 to RM3000 which applies to. ORANG RAMAI DIALU-ALUKAN UNTUK MENYERTAI KONSULTASI AWAM DENGAN HASiL. This has actually been announced earlier in 2021.

Employee Benefits That are Tax Deductible Employers. Personal Income Tax e-Filing for First Timers in Malaysia MyPF. Extended to YAs 2022 and 2023.

Tax Identification Number TIN Tax rebate for set up of new businesses. LHDN will implement tax identification numbers TIN for taxpayers starting from 2022 to broaden the income tax base. Tax relief for self-enhancement and upskilling course fees increased and extended.

Calculations RM Rate TaxRM A. Amount exempted RM Self and Dependents. LHDN has deferred the remittance of WHT until 31032022.

Everything You Should Claim For Income Tax Relief Malaysia 2021 YA 2020 Jacie. Latest Form BEe-Form BE with LHDN receipt or proof of tax paid Note. This relief is applicable for Year Assessment 2013 and 2015 only.

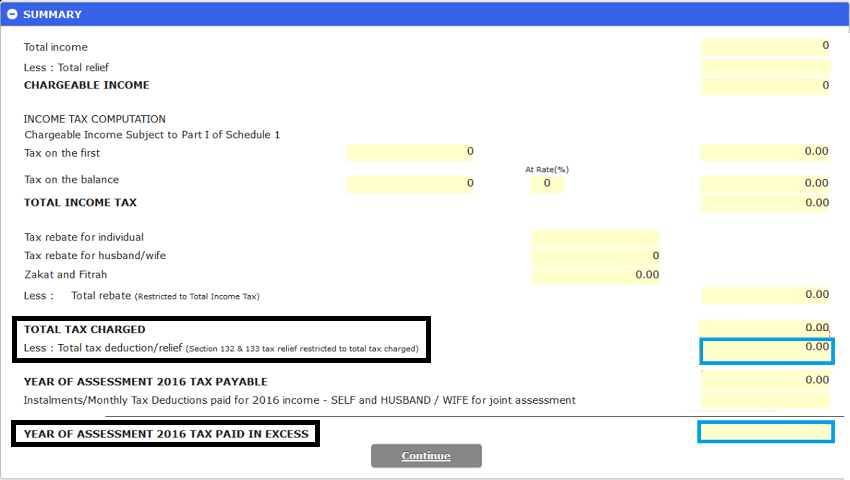

Individual tax relief up to RM1000 for the purchase of COVID-19 detection test kits for self spouse and child RM1000 tax rebate for vaccination expenses for self spouse and child. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. As the name suggests this will be done automatically by the system.

Youre eligible for an automatic tax deduction of RM9000 just by filling in the LHDN e-Filing form. A 2 Withholding Tax WHT will be imposed to agents dealers or distributors whose commission exceed RM100k within 1 year. Further education fees self.

The Government of Malaysia is fairly reasonable allowing us to get personal tax reliefs from lifestyle expenses such as gadgets and sports equipment to mandatory ones such as education and medical expenses for our parents and ourselves. In Budget 2020 an additional lifestyle tax relief for the purchase of personal computer smartphone or tablet for self spouse or child was added and extended to Year of Assessment 2021. Guide To Using LHDN e-Filing To File Your Income Tax.

Bagi meningkatkan ketelusan dan penglibatan awam dalam pentadbiran cukai langsung Lembaga Hasil Dalam Negeri Malaysia HASiL mengalu-alukan orang ramai untuk menyertai Konsultasi Awam. Everything You Should Claim As Income Tax Relief Malaysia 2022 YA 2021 Income Tax Malaysia. Personal Tax Relief 2021.

Is there a minimum amount of donation required to qualify for tax deductions. Whats New For YA 2021. Theres even a tax relief for alimony payments.

With that heres LHDNs full list of tax reliefs for YA 2021. How To File Your Taxes For The First Time. How much is taxable income in Malaysia for Year Assessment 2021.

On the First 5000 Next 15000. If you owned the property for 12 years youll need to pay an RPGT of 5. In addition to deducting tax relief from your annual income you can still reduce your chargeable income with tax deductions.

Personal Income Tax Number. Commercial Renovation Tax Exemption. You can also refer to the official LHDN list here.

On the First 5000. Whereas for salaried earners from Non MNC PLC GLC companies latest 1 month salary slip AND latest EPF statement with contribution records latest salary crediting bank statement are required. How To Pay Your Income Tax In.

Below is a list of personal income tax reliefs for filing in YA2021. LHDN did not set any such figures. Increment and Reduction in income tax.

These Are The Personal Tax Reliefs You Can Claim In Malaysia. Stay in Malaysia less than 182 days are taxed at flat rate of 28 without any personal reliefsdeductions and rebates. Tax Relief for Sdn Bhd Secretary Fee.

Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year Personal Tax Relief 2021. According to the notice from the LHDN the Tax Identification Number TIN has been officially implemented starting from 1st January 2022. According to LHDN Income Tax Rates page the chargeable income tax in Malaysia for Year Assessment 2021 follows the following table.

This is where you declare your purchases from last year that provide tax relief. Company Tax Deduction 2021. Special Income Remittance Program PKPP For Malaysian Tax Resident With Foreign Sourced Income.

Tax Return Forms. Extended until YA 2025. Update Your Latest Mailing Address to LHDN with e-Kemaskini.

There are some exemptions allowed for RPGT. How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief. Make sure to get your handphone number down correctly as LHDN will send you a TAC when you sign and submit your e-form and your bank account number must be accurate if you want to get your tax refund.

Self parents and spouse 1. Get personal finance news in your inbox weekly. For the full list of personal tax reliefs in Malaysia as of the.

Company Tax Deduction 2021. Besides that the disposal of asset under the Real Property Gains Tax Act 1976 will be relevant to you if youve sold any property in the. Additional lifestyle tax relief related to sports activity expended by.

Extension of tax relief for childcare centres and kindergartens fees up to RM3000. The tax rebate on medical treatment special needs and parental care has been increased from RM5000 in 2021 to RM8000 in 2022. RPGT Exemptions tax relief Good news.

For example if your chargeable income is. Tax relief on PRS contribution up to RM3000 until the year of assessment 2025. You are generally free to donate as much or as little as you like.

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020 Iproperty Com My

It S Income Tax Season Again But Don T Worry Here S A List Of All The Things You Can Claim As A Tax Relief For Ya 2021 Wau Post

Personal Tax Relief For 2022 Smart Investor Malaysia

Comparehero Want To Reduce Your Income Tax For Ya 2020 Remember To Claim These Tax Reliefs For Our Complete List Of Taxrelief Tips Visit Bit Ly 3t1qwsq Taxseason2021 Lhdn Incometax Facebook

Malaysia Personal Income Tax Guide 2020 Ya 2019

Income Tax Relief What Can You Claim In 2022 For Ya 2021

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

7 Tips To File Malaysian Income Tax For Beginners

Lhdn Irb Personal Income Tax Relief 2020

Prs Tax Relief Private Pension Administrator Malaysia Ppa

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Cukai Pendapatan How To File Income Tax In Malaysia

Fyi Lhdn 2018 Tax Relief Legend Financial Advisory Facebook

Watch This Before Filing Income Tax 2022 Pt 1 Complete Guide To File Tax Returns In Malaysia Youtube

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

7 Tips To File Malaysian Income Tax For Beginners

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Comments

Post a Comment